24+ Mortgage to salary ratio

The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. The standard salary to mortgage ratio used by lenders is 45 times an annual salary.

3wsowem2snelam

So if you earn 40000 per year you might be offered a mortgage of 180000 although that simple equation doesnt factor in any debt or outgoings you may have.

. Gross monthly income of 6500 x 29 1885 can be applied to housing. The 43 percent debt-to-income ratio is important because in most cases that is the highest ratio a borrower can have and still get a Qualified Mortgage. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

What More Could You Need. Principal interest taxes and insurance. Some mortgage lenders allow a higher debt-to-income ratio.

This means you can potentially borrow 45 times your annual salary as a mortgage. Principal interest taxes and insurance. With a 2941 FHA qualifying ratio.

For example an internist with the. You need to make 138431 a year to afford a 450k mortgage. We base the income you need on a 450k mortgage on a.

Suddenly the maximum amount they can borrow on their. Get Your Quote Today. The name for this rule comes from two measures of how your debt compares to your incomeyour front-end and back-end debt-to-income ratio DTI.

- SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower. 43 typically allowed 50 is possible USDA loan. There are some exceptions.

Its A Match Made In Heaven. 1200 400 400 2000. If you earn 250000 or more the same multiples will apply so simply multiply your salary by 4 45 or 6 to find out the kind of mortgage you may be able to borrow against your earnings.

Contact a Loan Specialist. This includes credit cards car. As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Up to 43 typically allowed 36 is ideal FHA loan. Your monthly debt payments would be as follows. To determine how much you can afford using this rule multiply your monthly gross income by 28.

Lender Mortgage Rates Have Been At Historic Lows. Ad Compare Your Best Mortgage Loans View Rates. How much do I need to make to afford a 450k house.

If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000 6000 033. Take Advantage And Lock In A Great Rate. Ad Work with One of Our Specialists to Save You More Money Today.

Were Americas 1 Online Lender. Front-end debt ratio sometimes called mortgage-to-income ratio in the context of home-buying is computed by dividing total monthly housing costs by monthly gross income. The standard salary to mortgage ratio used by lenders is 45 times an annual salary.

The front-end ratio includes not only rental or mortgage payment but also other costs associated with housing like insurance property taxes HOACo-Op Fee etc. Gross monthly income of 6500 x 36 2340 can be applied to recurring debt plus housing expenses. But suppose the borrower has credit issues and only qualifies with a higher mortgage rate of 45.

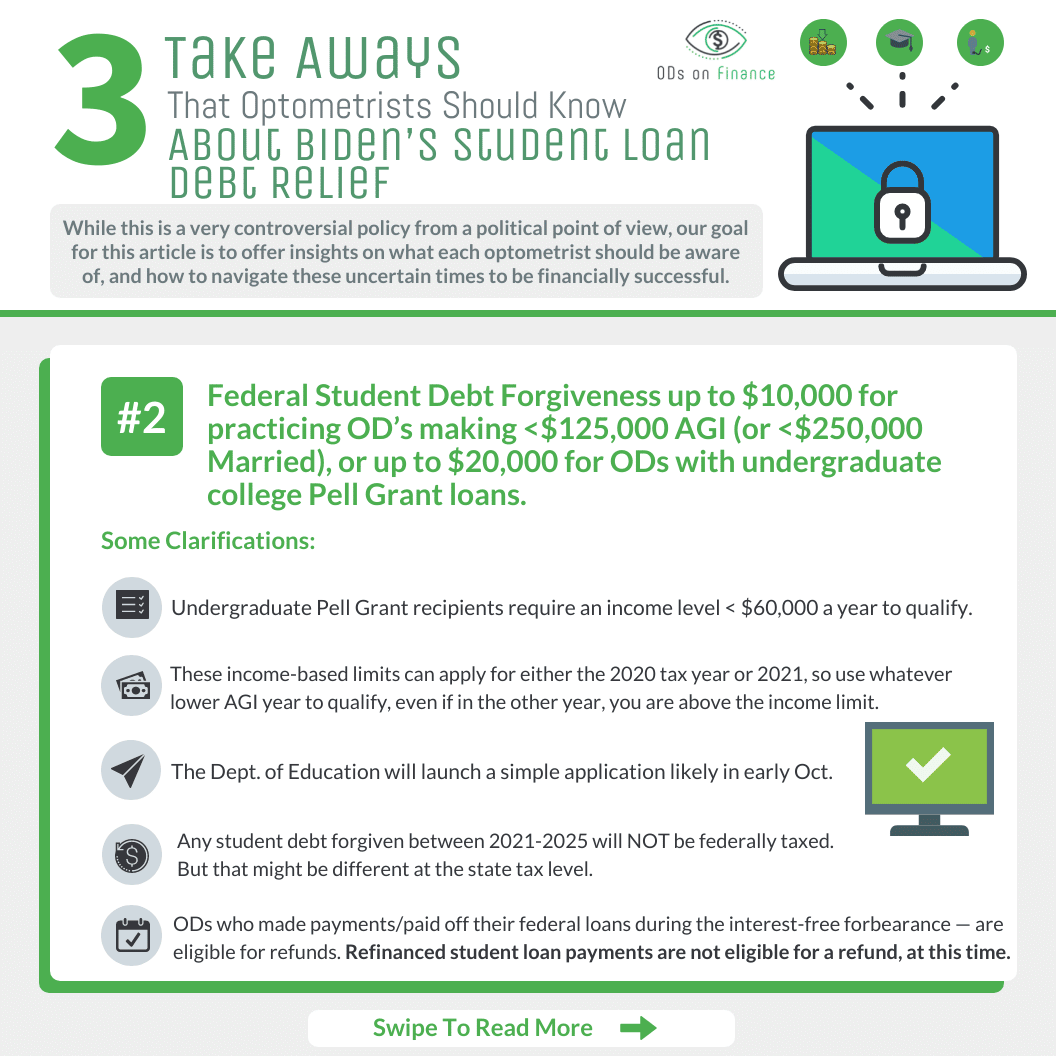

Maximum Student Loan Debt to Salary Ratio The White Coat. Rated Excellent by our customers Michael Get matched with the right mortgage broker We understand that each situation is unique. Compare Offers Side by Side with LendingTree.

41 is typical for most lenders. Looking For A Mortgage. Say your monthly income is 7000 your car payment is 400 your student loans.

Gross monthly income of 6500 x 41 2665 can be applied to recurring debt plus housing expenses. 41 is typical for most lenders. Perhaps a better way to look at it is to consider the ratio of student loan debt to peak earning salary.

The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments including housing. The 2836 DTI ratio is based on gross income and it may not include all of your expenses. In the US the standard maximum front-end.

The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. The debt-to-income ratio is one. In your case your monthly income should be about 11536.

Get the Right Housing Loan for Your Needs. Browse Information at NerdWallet. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

Debt-To-Income Ratio - DTI. Thats nearly six times their salary. Generally having a.

For example if you make 10000 every month multiply 10000 by 028 to get 2800. VA Loan Expertise and Personal Service. 24 Mortgage borrowing ratio Sabtu 03 September 2022 Edit.

Ad Learn More About Mortgage Preapproval. What is a healthy mortgage to income ratio. You can calculate your DTI ratio by adding up all your debt payments and dividing it by your gross monthly income.

The debt-to-income ratio should not exceed 36 of the gross income.

Awesome Debt Management Template Debt To Income Ratio Spreadsheet Template Excel Spreadsheets Templates

Nc10018789x1 Piemaiurix2 Jpg

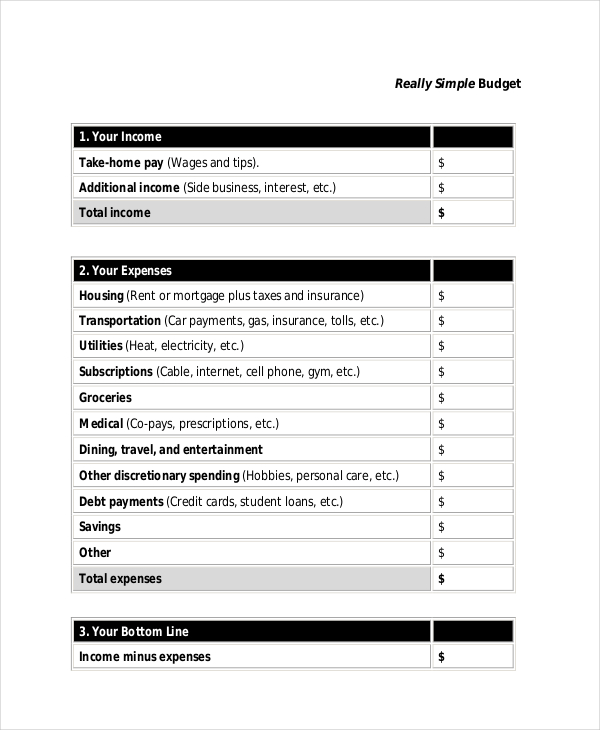

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

3 Day Closing Disclosure Rule Calendar Graphics How To Find Out Calendar Examples Calendar

Free 9 Sample Household Budget Worksheet Templates In Ms Word Excel Pdf Google Docs Google Sheets

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

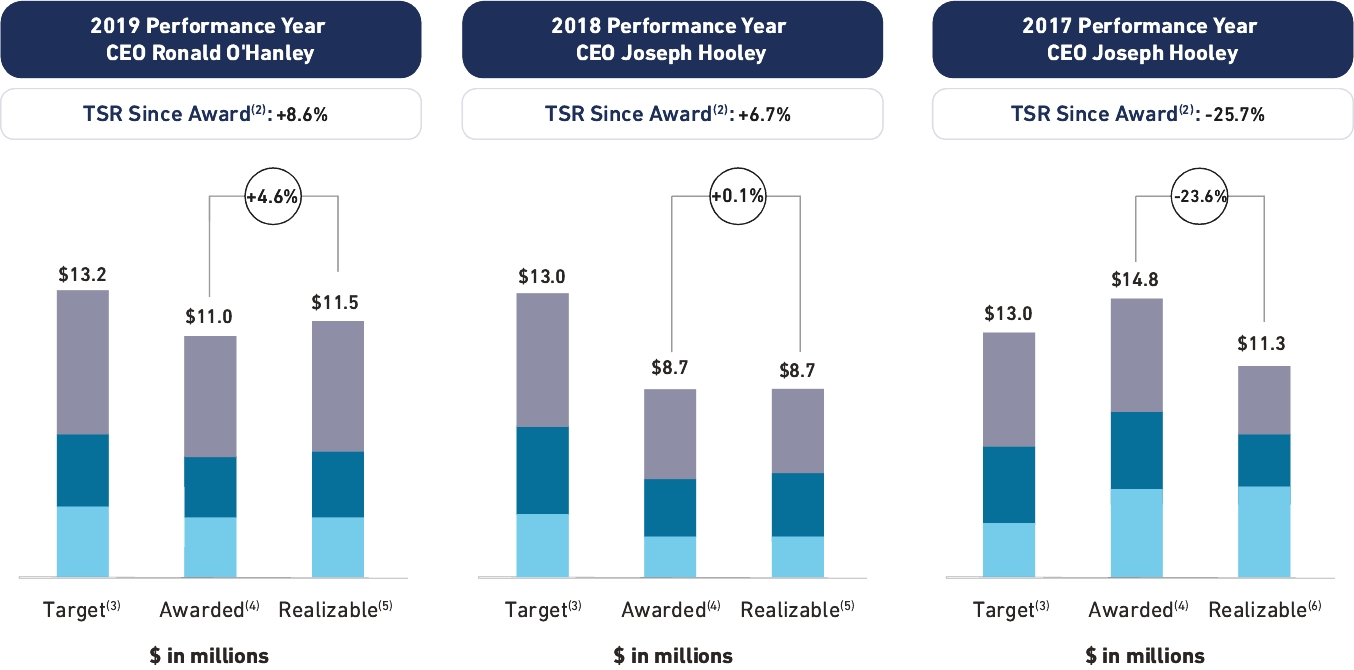

Nc10018789x1 Barchartsx3 Jpg

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Marc Bui S Instagram Video 100 000 Salary Is A Milestone Number For Many People It S Actually Quite Simple To Figure Out In 2022 Debt To Income Ratio People Salary

Tuesday Tip How To Calculate Your Debt To Income Ratio

Staffing Payroll Invoicing And Time Labor Software Timerack

3wsowem2snelam

10 Best Quick Personal Loans To Get Fast Emergency Cash Immediately

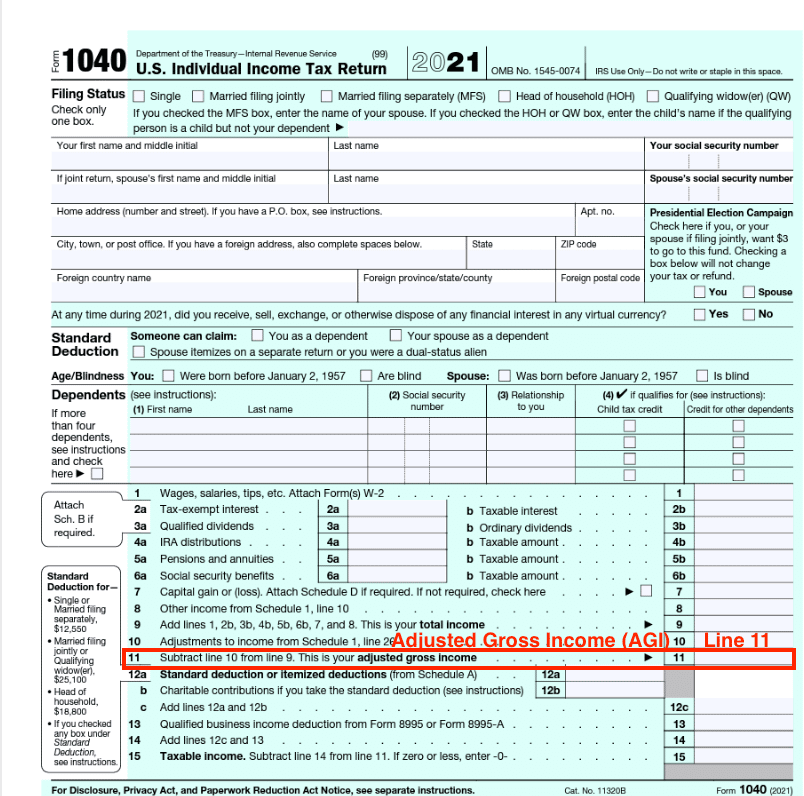

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Accounting Training

3wsowem2snelam

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Real Estate Tips

Pin On Personal Finance